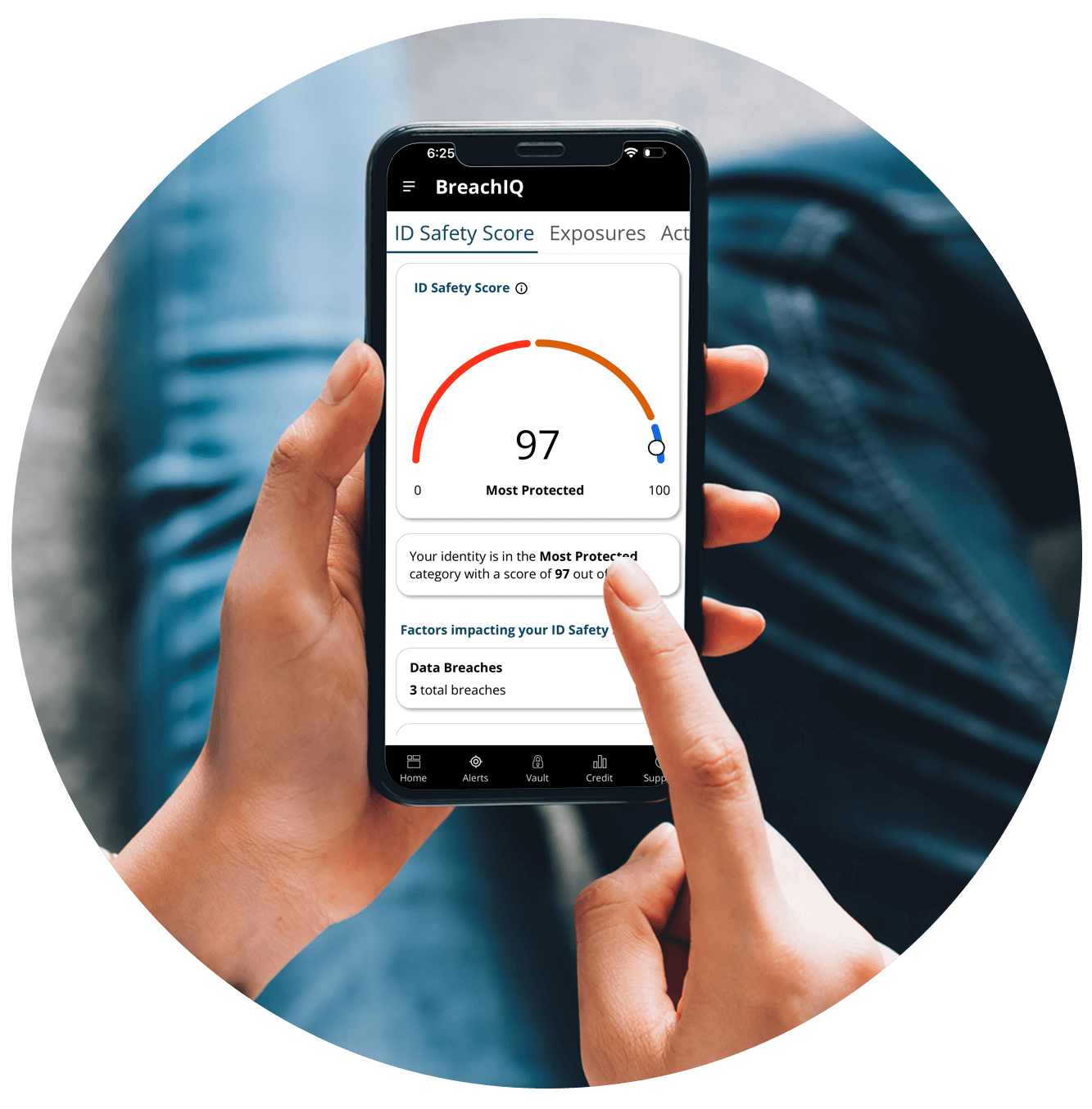

Identity theft prevention, at your fingertips.

Conveniently proactively protect your identity from anywhere.

Your Identity is personal. So is your protection.

More Personalized

You get a Personalized Action Plan and Personalized Identity Safety Score based on your actual breach history.

More Informed

Unlimited access to daily TransUnion® credit reports and 24/7 Dark Web monitoring and alerts.

More Protected

Identity Monitoring, Fraud Prevention and Theft Recovery for You and Your Family.

Anywhere, anytime identity theft prevention tools.

Personalized Action Plan

Get a personalized plan to help guide you to better protect yourself against identity threats based on your personal identity safety score.

VPN for Mobile

Provides a secure internet connection anywhere you go and encrypts the data being transmitted or received over your phone’s Wi-Fi connection so hackers and thieves cannot see your information.

Online PC Protection Tools

Anti-phishing and anti-keylogging software protect you while you’re shopping, banking, and sharing online from your PC. Proactively prevent malware from stealing your sensitive data such as username, password, credit card number, bank account details, and other personal information you may type on your PC keyboard.

Identity Vault

Online encrypted storage for your important personally identifiable information (PII) including SSNs, credit cards, financial account information and birth dates, along with other important documents. Access to online and mobile digital organization and storage of digital copies of important legal and personal documents, medical records, and other items.

Password Manager

As your first line of defense for protecting your personally identifiable information against identity crimes, our Password Manager is a must-have — giving you on-the-go access to manage your passwords in one secure easy-to-use location. You also have access to a password tool to test strength and generate strong passwords.

Mobile App

Anywhere, anytime protection with all the key capabilities required to rapidly access personal identity protection information from your smartphone (iOS and Android). Includes Mobile Attack Control™, which monitors and alerts you to a wide array of threats including rogue apps, spyware, unsecured Wi-Fi connections, and fake or “spoof” networks. Additionally, Secure My Network (VPN), ensures you have a secure internet connection anywhere, encrypting inbound and outbound data so hackers can’t see sensitive personal information.

Identity theft is an expensive headache. Shielding yourself and your family doesn’t have to be.

Starting at $19.90 per month, get award-winning identity theft protection from a provider with 19 years experience.

- Individual Plans

- Family Plans

† Coverage varies in New York

†† All 3 national credit bureaus: TransUnion®, Experian®, and Equifax®

† Coverage varies in New York

†† All 3 national credit bureaus: TransUnion®, Experian®, and Equifax®

Recommended from leading identity theft protection review sites.

Frequently Asked Questions:

To protect your online information, use strong, unique passwords for each account, enable two-factor authentication where available, be wary of phishing emails and suspicious links, regularly update software and security features, and limit the amount of personal information you share on social media.

Identity theft protection services can be beneficial as they monitor various data and records to alert you of potential fraud. They often provide additional services like credit monitoring, recovery assistance, and insurance for losses due to identity theft. They evaluate your personal risk and needs to decide if such a service is right for you.

If you lose important documents, report the loss to the issuing authority immediately, monitor your credit reports and bank statements for unusual activity, consider placing a fraud alert on your credit files, and, if necessary, file a report with the police.

Signs of identity theft include unexplained withdrawals from your bank account, calls or bills for services you didn’t use, unfamiliar accounts or charges on your credit report, medical bills for services you didn’t receive, and a sudden drop in your credit score without an apparent reason. If you notice any of these signs, take immediate action to investigate and resolve the issue.

The credit scores provided are based on the VantageScore® 3.0 model. Lenders use a variety of credit scores and are likely to use a credit score different from VantageScore® 3.0 to assess your creditworthiness.