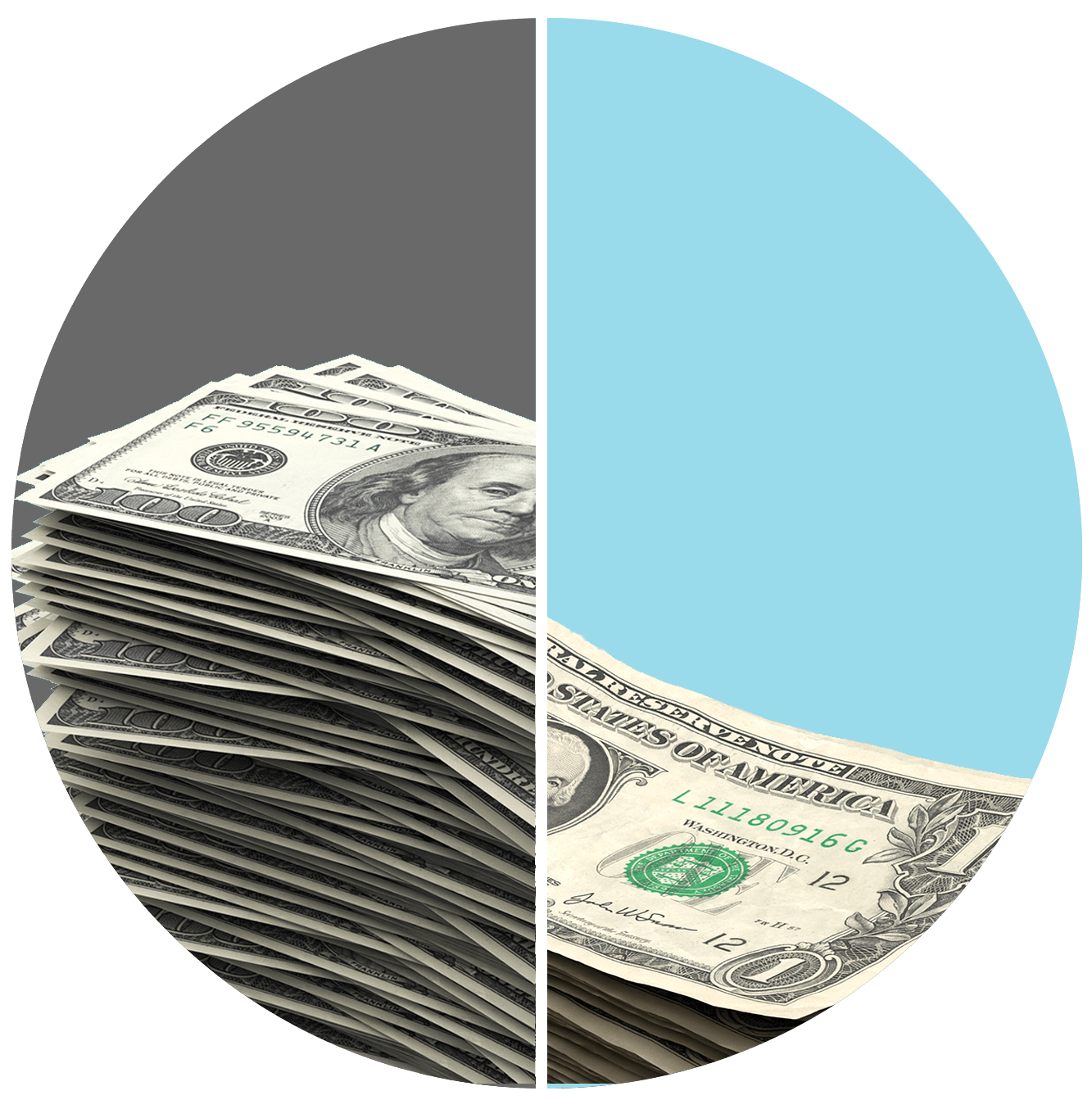

Identity theft could cost you $1,160.

Or get identity theft protection for as low as $19.90/mo.

(Source: Mean cost of identity theft $1,160 - Bureau of Justice Statistics 2023)

Identity theft is an expensive headache. Shielding yourself and your family doesn’t have to be.

Starting at $19.90 per month, get award-winning identity theft protection from a provider with 19 years experience.

- Individual Plans

- Family Plans

† Coverage varies in New York

†† All 3 national credit bureaus: TransUnion®, Experian®, and Equifax®

† Coverage varies in New York

†† All 3 national credit bureaus: TransUnion®, Experian®, and Equifax®

Recommended from leading identity theft protection review sites.

Frequently Asked Questions:

Here’s what you need to do:

- Login to your dashboard and select, “Manage Account” from the left-hand navigation

- Scroll down to the “Protection Plan” section (Just above “Lost Wallet Assistance”)

- You will see an option to select “Payment History”

- You can screenshot up to the last 10 transactions for yearly payment history

It’s easy. Just log into your Dashboard and select Protection Plan from the drop-down menu in the top-right corner.

You can also call Member Services at 877-694-3367 Monday–Friday 8:00 a.m.–8:00 p.m. EST; Saturday and Sunday, 9:00 a.m.–7:00 p.m. EST (excluding major holidays). They’ll be happy to assist you.

We don’t want to lose you, but if you wish to cancel your membership, you can do so at any time. When you cancel, your membership ends immediately. You will not be billed again and all purchases offer a pro-rated refund for the unused portion of the services.

To cancel online:

- Log into your member dashboard (https://transunion.identityforce.com/app/Login)

- Go to the drop-down menu in the top right-hand corner of the screen

- Select the Protection Plan tab

- Click the Cancel button under your Current plan

To cancel by phone:

Call Member Services at 877-694-3367.

The credit scores provided are based on the VantageScore® 3.0 model. Lenders use a variety of credit scores and are likely to use a credit score different from VantageScore® 3.0 to assess your creditworthiness.